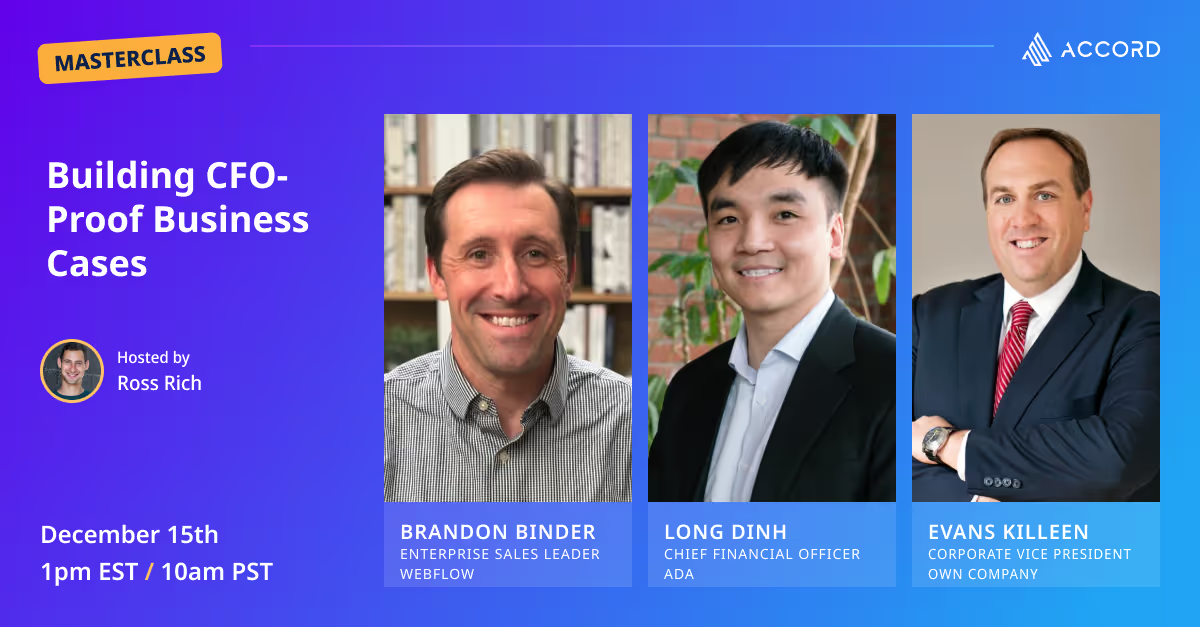

Hear from finance and revenue leaders from Ada, Webflow, and Own Company for practical tips on building business cases that address concerns, demonstrate clear ROI, and drive sustainable growth and efficiency.

If you’re struggling to craft a compelling business case that will win the approval of even the most discerning CFOs, you’re not alone. In this challenging macroeconomic environment, financial decision makers are more critical than ever of new initiatives and their potential impact on the organization’s bottom line. With tighter budgets and increased scrutiny on every dollar spent, the pressure is on to present a case that is not only convincing but also backed by solid data and aligned with long-term strategic goals.

In this masterclass, finance and revenue leaders from Ada, Webflow, and Own Company share insight into how to build a business case that addresses these concerns head-on, providing practical tips on how to demonstrate clear ROI, mitigate risks, and showcase how your initiative can drive sustainable growth and efficiency.

Watch the full masterclass and get their advice below!

A business case is a document or presentation that advocates for the initiation of a project, detailing its purpose, benefits, and alignment with organizational goals. It’s used to persuade stakeholders to allocate resources for the project's execution.

Generally speaking, a business case needs to:

There isn’t a one-size-fits-all template for building one. Instead, each business case should be tailored to the prospect and include:

Keep it simple so it’s accessible to non-technical stakeholders as well. Ultimately, you want the prospect to be able to own it and make it their own.

Ada’s CFO, Long Dinh, emphasizes the importance of grounding business cases in data-driven and realistic assumptions. “Whenever someone presents a new initiative to me, my initial questions focus on two aspects: firstly, whether their assumptions are realistic, and secondly, if they understand our existing business metrics.”

Rather than being overly optimistic about the numbers and timelines, it’s better to provide a full-scope analysis. This outlines both the best and worst-case scenarios, thereby painting a more realistic picture of potential outcomes and showing stakeholders that you’ve considered all potential realities.

To build a strong business case, clearly define and categorize your cost savings. This will help you articulate the value of a solution or strategy. Typically, you can divide savings into the following three categories:

“A big misconception is that CFOs are cheap and don’t want to spend any money,” says Brandon Binder, Enterprise Sales Leader at Webflow. “This isn’t true — they have money and they have targets. But they want to spend money on the right things. When you make your business case, you need to illustrate the importance of the proposed initiative, and tailor it to your prospect’s needs.”

Knowing financial stakeholders will be analyzing your business case through this lens, ask probing questions about the existing resources and how they’re used, then prepare a compelling case for how your tool or service solves specific pain points. Make sure your business case highlights the cost savings while also considering the broader impact on the organization’s efficiency, productivity, and strategic goals. This includes evaluating the potential risks and downsides of not implementing the proposed changes.

To prepare a winning case, conduct an in-depth discovery phase where you uncover the specific needs and challenges of the organization. Ask questions. Tweak your business case to your audience, and most importantly — know who your audience is.

“Unfortunately, many times you’re not the one presenting the business case,” says Evans Killeen, Corporate VP at Own Company. “You need to coach whoever is going to be presenting that business case, and make sure they represent it in the right way because chances are, you aren’t going to be in the room when it gets to the CFO or decision maker.”

Most sales people may get one to two hours with stakeholders. Behind the scenes, there may be 12+ hours of internal discussion such as debriefs, finance meetings, budget meetings, and contract negotiations. To craft a CFO-proof business case, your narrative should focus on the organization's key objectives, be grounded in reality, and demonstrate clear ROI.

As we've learned from the insights of finance and revenue leaders from Ada, Webflow, and Own Company, the key to building a successful business case lies in understanding your audience's priorities and crafting a narrative that resonates with them. It's not just about the numbers, but how these figures align with the strategic objectives and risk profile of the organization.

Whether it's through demonstrating cost savings, efficiency gains, or risk mitigation, your business case should be a carefully constructed story that speaks to the heart of financial decision-making. By following the expert advice and strategies discussed in this masterclass, you can create compelling, data-driven proposals that stand out to CFOs and drive your initiatives forward.

To learn more, watch the full masterclass here.